Many individuals find themselves in situations where a business loan becomes a compelling solution to address specific pain points in their entrepreneurial journey. If your business is facing a temporary cash flow shortage, an HDFC Business Loan can provide the necessary working capital to keep operations running smoothly. You can also use HDFC business loan in managing day-to-day expenses, paying suppliers, and meeting short-term financial obligations. A business loan from HDFC allows you to acquire the necessary equipment without putting undue strain on your working capital.

Please note: Responsible repayment of a business loan contributes positively to your credit history. This, in turn, can enhance your business’s creditworthiness, making it easier to secure financing in the future for larger ventures.

About HDFC Business Loan

| Name | HDFC Ltd. |

| Founded (in Year) | 1977 |

| Company | Banking & Financial Services Company |

| Services | Banking & Finance Services |

| Headquarter | Mumbai |

| Business Loan Type | Vary |

| Loan Tenure (in Month) | 12 – 48 |

| Loan Amount | up to ₹50 Lakh ( up to ₹75 lakh in selected locations ) |

HDFC Ltd., a trusted banking and financial services company founded in 1977, offers versatile business loans without the need for collateral, guarantor, or security. Tailored to meet diverse needs, these loans support business expansion, working capital, or any personal endeavour.

With a user-friendly tenure of 12 to 48 months, individuals can secure amounts up to ₹50 lakh (₹75 lakh in specific locations). Headquartered in Mumbai, HDFC Ltd. stands as a reliable choice for those seeking hassle-free financial solutions.

HDFC Business Loan Interest Rates

| Business Loan Interest Rate | Min 10.00% and Max 22.50% |

HDFC Business Loan features competitive interest rates, ranging from a minimum of 10.00% to a maximum of 22.50%. This provides businesses with flexible financing options. The lower interest rate starting point ensures affordability, while the higher cap accommodates varying financial circumstances.

Aspiring business personals can benefit from this range, tailoring their loan choices to suit their specific needs. Whether initiating a new venture or expanding an existing one, HDFC’s Business Loan Interest Rates cater to a diverse range of businesses, promoting financial accessibility and growth.

HDFC Business Loan Types

| Business Loan to Trader | Loan to Self-Employed |

| Business Loan to Manufacturer | Business Loan to CA |

| Business Loan for Doctors | Business Loan for Women |

HDFC offers a diverse range of business loan types catering to various professionals, including traders, self-employed individuals, manufacturers, chartered accountants, doctors, and women entrepreneurs.

Additionally, you have the option to transfer your existing business loan to HDFC Bank, benefiting from lower EMIs and attractive interest rates. This flexibility ensures that entrepreneurs from different sectors can find suitable financial solutions with ease.

Read more: How to Start a Hotel Business Like OYO?

HDFC Business Loan Eligibility

| Eligibility Criteria | Requirement |

|---|---|

| Business Type | Self-employed individuals, proprietors, private ltd. co., and partnership firms involved in manufacturing, trading, or services. |

| Minimum Turnover | ₹40 lakhs per annum |

| Business Experience | Minimum 3 years in the current business, with a total of 5 years of business experience. |

| Profitability | The business should have been profit-making for the previous 2 years. |

| Minimal Annual Income (ITR) | ₹1.5 lakhs per annum |

| Age at the time of application | At least 21 years |

| Age at the time of loan maturity | Not older than 65 years |

HDFC Bank offers a swift Business Loan eligibility check, taking just 60 seconds online or at any of its branch. Loans are granted based on your repayment history with Home Loans, Auto Loans, and Credit Cards.

Existing Business Loan holders can seamlessly transfer to HDFC Bank for lower EMIs, enjoying attractive interest rates. The loan service caters to self-employed individuals, proprietors, private ltd. companies, and partnership firms in manufacturing, trading, or services.

Eligibility criteria include a minimum annual turnover of ₹40 lakhs, 3 years in the current business, 5 years of total business experience, profitability for the past 2 years, a minimum annual income of ₹1.5 lakhs, and an age range of 21 to 65 years.

HDFC Business Loan Fees & Charges

| Fee/Charges | Details |

|---|---|

| Rack Interest Rate Range | Minimum 10.00% and maximum 22.50% |

| Loan Processing Charges | Up to 2.00% of the loan amount |

| NIL Processing Fees for loans up to ₹5 Lakhs for micro and small Enterprises with URC submission before disbursal | |

| Premature Closure Charges (Full Payment) | Up to 24 EMI: 4% of principal outstanding |

| 24-36 EMI: 3% of principal outstanding | |

| Post 36 EMI: 2% of principal outstanding | |

| Premature Closure Charges (Part Payment) | Post 01-24 EMI: 4% of part payment amount |

| 24-36 EMI: 3% of part payment amount | |

| Post 36 EMI: 2% of part payment amount | |

| Partial payment allowed up to 25% of Principal Outstanding, once in a financial year, and twice during the loan tenure | |

| NIL Charges | NIL Premature Closure Charges for Fixed-rate loans up to ₹50 Lakhs for Micro & Small Enterprises with Udyam Registration Certificate before disbursal |

| Loan Closure Letter | NIL |

| Duplicate Loan Closure Letter | NIL |

| Solvency Certificate | Not applicable |

| Delayed Instalment Payment Charge | 18% p.a + applicable government taxes on overdue instalment amount |

| Charges for Changing Interest Rate | Not applicable |

| Stamp Duty and Other Statutory Charges | As per applicable state laws |

| Repayment Mode Change Charges | ₹500 |

| Amortization Schedule Charges | Repayment Schedule Charges: Rs. 50/- per schedule for physical copy |

| Payment Return Charges: ₹450 per instance | |

| Legal/Incidental Charges | At actuals |

| Loan Cancellation & Rebooking Charges | Loan Cancellation Charges: Within cooling off/look-up period |

| Rebooking Charges: ₹1000/- + applicable government taxes |

HDFC offer a transparent breakdown of its fees & charges for its business loan service. The interest rate spans 10.00% to 22.50%, with processing fees up to 2.00%. Sanctioned loan amount under ₹5 Lakhs for small enterprises enjoy zero processing fees with URC submission.

Premature closure charges vary: 4% up to 24 EMIs, 3% up to 36 EMIs, and 2% thereafter. Part payment incurs charges from 4% to 2% based on the EMI period. No premature closure charges apply to fixed-rate loans under ₹50 Lakhs for registered Micro & Small Enterprises.

Various charges like repayment mode change, amortization schedule, and legal fees are specified in the table above, ensuring clarity.

Documents Required for HDFC Business Loan

| Documents | Details |

|---|---|

| PAN Card | For Company/Firm/Individual |

| Identity Proof (Any of the following) | – Aadhaar Card – Passport – Voter’s ID Card – PAN Card – Driving License |

| Address Proof (Any of the following) | – Aadhaar Card – Passport – Voter’s ID Card – Driving License – Bank statement of the previous 6 months |

| Financial Documents | – Latest ITR with computation of income – Balance Sheet for the previous 2 years – Profit & Loss account for the previous 2 years (CA Certified/Audited) |

| Proof of Continuation | – ITR/Trade license/Establishment/Sales Tax Certificate |

| Other Mandatory Documents | – Sole Prop. Declaration – Certified Copy of Partnership Deed – Certified true copy of Memorandum & Articles of Association (certified by Director) – Board resolution (Original) |

To apply for an HDFC Business Loan, ensure you have these documents: PAN Card (for Company/ Firm /Individual), and Identity Proof (Aadhaar, Passport, Voter’s ID, PAN, or Driving License). Address Proof can be Aadhaar, Passport, Voter’s ID, Driving License, or the last 6 months’ bank statement.

Financial documents include the latest ITR, Balance Sheet, and Profit & Loss account for the past 2 years (CA Certified/Audited). Proof of Continuation requires ITR, Trade license, Establishment, or Sales Tax Certificate.

Other mandatory documents encompass Sole Prop. Declaration, Certified Partnership Deed, Memorandum & Articles of Association (certified by Director), and Original Board resolution.

HDFC Business Loan Customer Care

| HDFC Business Loan Customer Care Number | 1800 202 6161 / 1860 267 6161 |

| HDFC Business Loan Customer Care Number (Abroad Customers) | +9122 61606160 |

For HDFC Business Loan customer support, assistance is accessible daily, including Sundays and holidays, from 8:00 a.m. to 8:00 p.m. The contact numbers are listed above, and for international customers, a separate number is provided.

Business personal seeking help or information regarding their business loans can use the provided numbers.

HDFC Business Loan Login Page

| Apply for HDFC Business Loan | Apply Link |

Using the provided link you can access HDFC Page which provides entrepreneurs access to their loan information effortlessly. The ease of navigation of the site allow borrowers to review loan details, track payments, and manage account information seamlessly. The overall process to apply for HDFC Business loan has been detailed below.

How to Apply for HDFC Business Loan?

1. First of all, go to HDFC Business Loan login page using the provided link above.

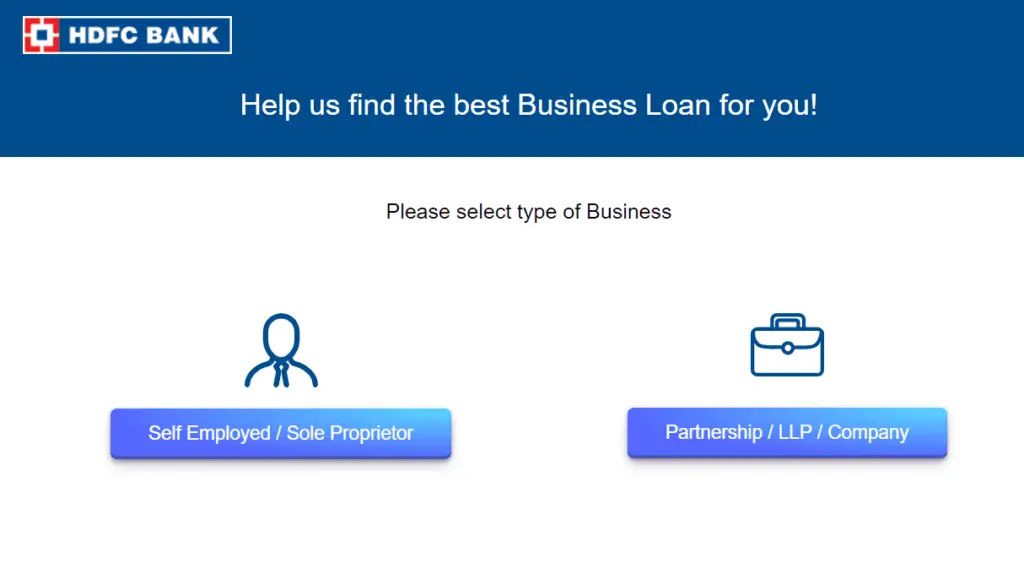

2. As you can see in the image below, you are given the option to choose between “Self Employed/Sole Proprietor” or “Partnership/LLP/ Company”. (Choose Self Employed/Sole Proprietor” if you run a business individually, otherwise choose Partnership/LLP/ Company if you own a company.)

3. Since the application process for HDFC Business Loan is different for a sole proprietor and company, you will be choosing the option wisely.

4. As an individual, your income and eligibility for the business loan is confirmed through PAN Card. Similarly, business-specific details are asked if you are approaching as a company.

5. On the application page, once after you finish filling all the necessary details, a representative from HDFC Ltd contacts you on your registered mobile number.

6. In the subsequent process, your eligibility is checked and you are asked to submit the provided list of documents. The approval of business loan is subject to terms & conditions.

7. Once your eligibility for the business loan is confirmed, an eligible loan amount is sanctioned by the HDFC on your name/or on the name of your company.

8. The loan amount is then disbursed to your bank account following further verifications.

Additional Features of HDFC Business Loan

Here’s a break down of additional notable features which are covered under the HDFC Business Loan Scheme

Credit Protect Option:

- Nominal premium to cover the loan.

- Pays off the loan on customer’s death.

- Provides life coverage for peace of mind.

Financial Security:

- No need to use personal savings for loan repayment.

- Tax benefits as per laws.

Convenient Package:

- Combines loan and insurance.

- Premium deducted from the loan amount at disbursal.

Payment Protection Insurance:

- Covers outstanding loan in case of natural/accidental death.

- Maximum coverage up to the loan amount.

Transfer Your Business Loan to HDFC:

- Lower EMIs.

- Attractive interest rates for loan transfers.

- Flexible tenure up to 48 months.

For more information, please contact the HDFC Ltd representatives who will guide you thoroughly about the business loan process and your eligibility for the service.