Good News for all self-employed individuals who are independent workers and playing a pivotal role in fostering innovation and driving entrepreneurship in the country. HDFC Bank business loans for self-employed individuals is here.

HDFC Bank India’s largest private sector bank is known for actively supporting self-employed entrepreneurs through its convenient loan disbursal process.

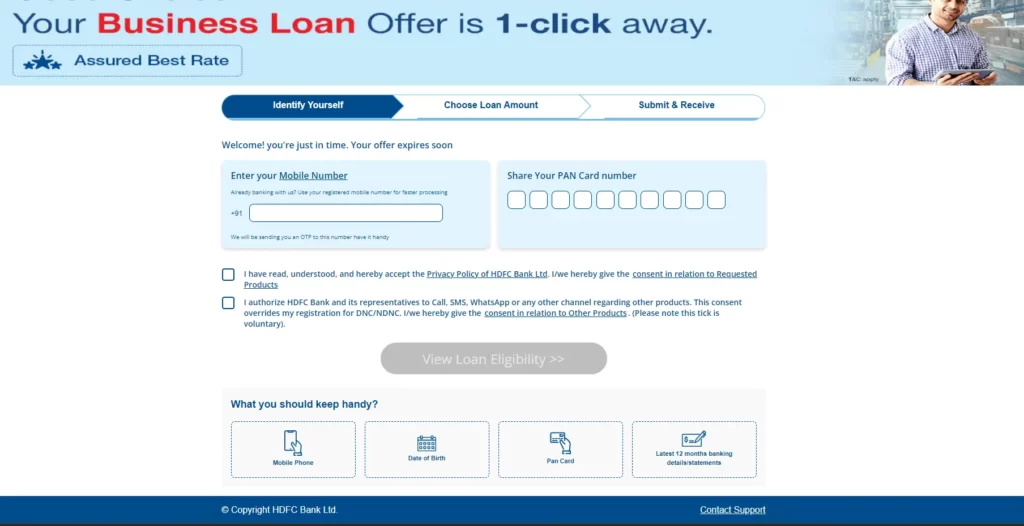

For pre-approved customers, the bank disburses loans within a mere 10 seconds, for non-HDFC Bank customers, the loan approval process is remarkably swift, with funds disbursed within 4 hours of application.

Read More: HDFC Business Loan – Interest Rate, Eligibility, Documents

Understanding the diverse nature of self-employment, HDFC Bank extends its business loans to a wide array of entrepreneurial ventures. Whether you are involved in professional role (doctor, architect, etc.) or a non-professional businessperson (entrepreneur, start-up owner, existing business firm owner), – HDFC Bank is poised to support your business aspirations.

For those considering a business loan, it is crucial to note that HDFC Bank offers flexible repayment terms, allowing self-employed individuals to choose a plan that aligns with their financial capabilities. Additionally, HDFC Bank acknowledges the varying age brackets within the self-employed sector, with an age limit for both salaried and self-employed individuals ranging from 21 to 65 years.

To Apply for HDFC Business Loan to Self Employed, You Can Follow the Provided Steps:

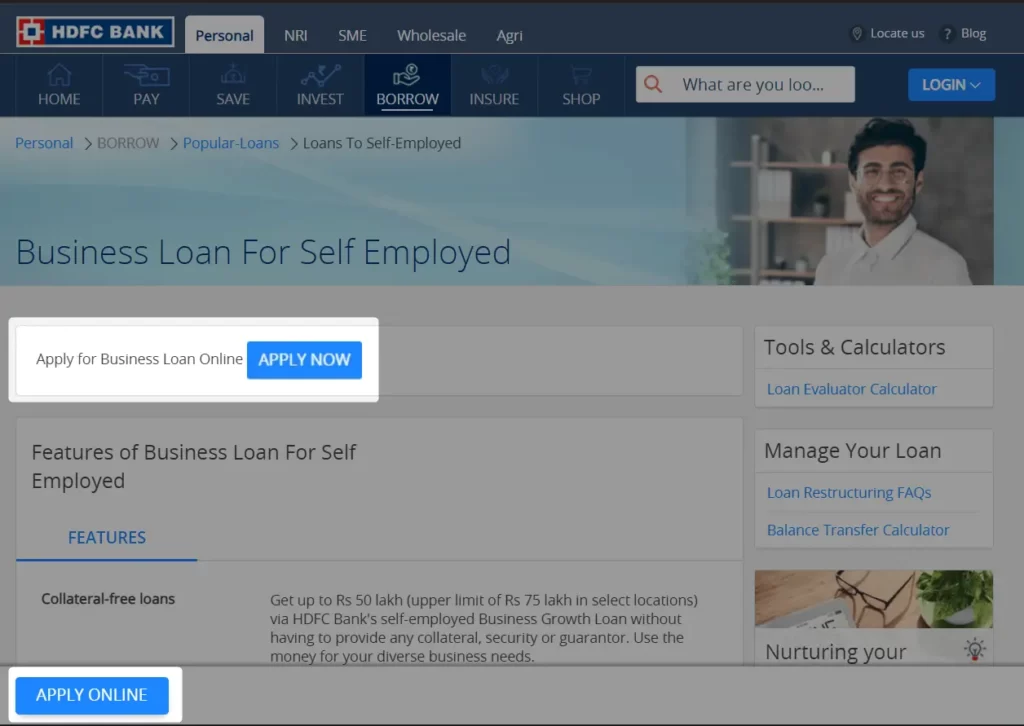

Step 1: First of all, go to HDFC Official Portal using the provided LINK which will take to the bank’s official page which is about Business Loan to Self Employed. If you are an existing customer of the bank, you can simply proceed the process online. Otherwise, a representative will contact you using the provided details that you provide to check your eligibility.

Step 2: Here on the page, you’ll see all the features of HDFC Business loan to self employed. The bank offers self-employed Business Growth Loan and the best part, it doesn’t asks you for collateral, security, or guarantor ! You can access up to Rs 50 lakh (or up to Rs 75 lakh in specific locations) to fulfill various business needs.

Step 3: The bank provides you the the flexibility to check your eligibility for the business loan either online or by visiting any of HDFC branches. If you are eligible, you only need to provide just a few basic documents to apply.

Step 4: Check the HDFC Bank Business Loan rate of interest which start from Minimum 10.00% and can go up to maximum 22.50%, depends on T&C associated with the loan. If you are a senior citizen, you can get an additional 10% discount on all service charges.

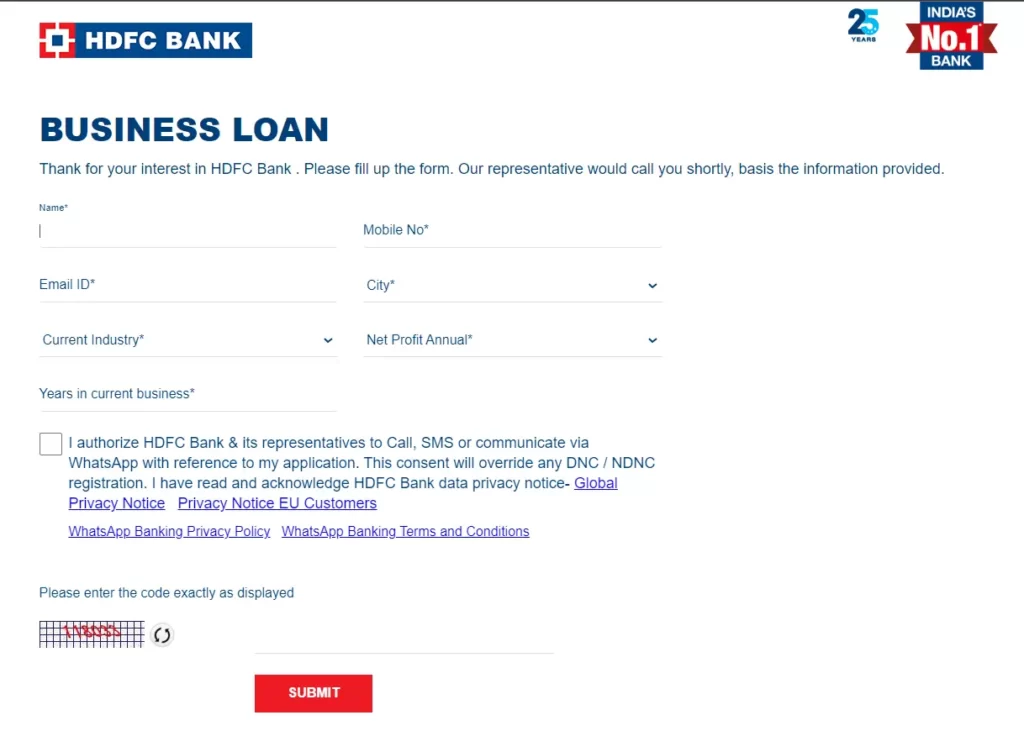

Step 5: On the application page, the official website of the bank asks you to provide few details about you including your Name, Mobile No., Email ID, City, Current Industry, Net Profit Annual, and for how many years you are working in the current business. After you submit all the details, a representative then call you shortly based on the information provided who then guides you about the whole process.

However, the HDFC loan can be availed easily by the existing customers of the private bank. If you are self-employed and already have a saving account at HDFC, you can apply for the business loan directly through bank’s online portal, officially available for existing customers.

HDFC Bank business loans can be availed at an attractive interest rate ranging between for self-employed individuals, and you can choose to repay the loan over a period of 12 to 48 months. This flexibility allows you to pick a repayment schedule that suits your financial situation.