In 2024, the landscape of Fintech Startups in Bangalore remains a focal point for both the public and investors, showcasing the dynamic growth of India’s burgeoning fintech market. Valued at USD 31 billion, this market stands as the globe’s third-largest, underscoring the country’s significance in driving financial technology innovation.

Meanwhile, Bangalore, often called the Silicon Valley of India, stands out as a vibrant hub for innovative financial technology endeavours. Home to over 3,085 fintech companies as of August 2023, Bangalore’s favorable startup ecosystem, skilled workforce, and robust infrastructure contribute to its prominence in the fintech domain.

Amidst the multitude of options, this list highlights the 10 Hottest Fintech Startups in Bangalore, offering a glimpse into the city’s dynamic and ever-evolving fintech landscape for the year 2024.

#1 Kissht Finance

Founded in 2015 by Krishnan Viswanathan and Karan Mehta, Kissht, one of the popular Fintech startups in Bangalore, operates as a financial technology platform facilitating instant credit for consumers at digital points of sale. The company’s plug-and-play gateway APIs seamlessly integrate into merchant checkout pages and retail POS, providing swift access to loans.

Kissht strategically collaborates with non-banking financial institutions, creating an ecosystem that enhances individuals’ borrowing capacities. This B2C startup has successfully partnered with over 3000 offline merchants and 50 online stores across 40 cities in India, showcasing its extensive reach and network.

The company’s parent entity, OnEMi Technologies Pvt Ltd, reported an impressive revenue of Rs 1,037 crore for the fiscal year ending March 2023, marking a remarkable 100% increase from the previous year’s revenue of Rs 517 crore. Kissht primarily generates revenue through processing fees and marketing income.

#2 Intellect Design Arena

Intellect Design Arena, one of the profitable Fintech Startups in Bangalore, operates globally as a leading IT software company specializing in digital transformation solutions for the financial sector. Established in 2011 by Arun Jain, the Founder of Polaris Group and the Chairman & Managing Director of Intellect Design Arena Ltd. The company caters to banking, insurance, and other financial entities with services like corporate banking, retail banking, treasury management, brokerage solutions, and insurance software.

The company’s approach involves selling enterprise-grade products and platforms across 57 countries, positioning itself as the world’s first full-spectrum Financial Technology Company in Banking, Insurance, and Capital Markets. Intellect Design Arena Ltd has grown its net profit by an impressive 35.92% year-over-year, reaching ₹84.31Cr in the third quarter of 2023-2024.

Currently, the company boasts a substantial employee network, employing over 5,001 to 10,000 individuals. The success and growth indicators underscore Intellect Design Arena’s impactful presence in the Fintech landscape.

#3 Acko

Acko, one of the Fintech startups in Bangalore, stands out for its unique online insurance model. Established in 2016 by Varun Dua, (shark tank india season 3 judge) Acko operates as a digital-first direct-to-consumer company, utilizing technology and services platforms to provide premium insurance facilities to the customers. Their approach eliminates paperwork entirely, offering customers a hassle-free and efficient experience to have car insurance, health insurance, life insurance and other insurance.

By leveraging digital platforms, Acko ensures that all operations are streamlined and conducted online, avoiding the need for intermediaries and reducing costs. The company distinguishes itself by offering bite-sized insurance products with zero commissions. This innovative approach sets Acko apart in the competitive landscape of insurance providers.

In the 2023 fiscal year, the company reported an impressive revenue from operations amounting to Rs 1,758.6 crore, marking a 32% increase from the previous year. However, it’s essential to note that this growth in revenue, on the other hand, was accompanied by an increase in losses for Acko.

#4 PhonePe

PhonePe, one of the prominent Fintech startups in Bangalore, operates as a digital payments and financial services company. Established in December 2015, it was founded by Sameer Nigam, Rahul Chari, and Burzin Engineer, with its headquarters located in Bengaluru, Karnataka, India. The company’s primary focus is on providing digital payment solutions to its users.

PhonePe functions on a freemium business model, offering basic services for free while charging for premium features. The revenue model involves earning a commission from telecom operators for recharges. The PhonePe app, based on the Unified Payments Interface, went live in August 2016, and as of November 7, 2023, it boasts over 500 million registered users. This impressive user base translates to approximately one in three Indians utilizing PhonePe’s services.

Highlighting the financial performance, PhonePe recorded a substantial 77% year-on-year surge in revenue for the financial year 2022-23, reaching ₹2,914 crore compared to ₹1,646 crore in the previous fiscal year.

#5 Razorpay

Razorpay, one of the well-known Fintech startups in Bangalore, specializes in providing online payment gateway services. Company’s business model is simple. Businesses using their platform are charged a fee for each transaction processed.

To facilitate seamless transactions, Razorpay provides APIs that businesses can integrate into their websites or mobile apps. Access to these APIs comes with a fee, and businesses can accept payments by paying a 2% platform fee, with an additional 18% GST.

Founded in 2014 by Harshil Mathur and Shashank Kumar, Razorpay primarily operates as a B2C and SaaS firm in Bangalore. The company’s revenue run rate in 2023 reached an impressive $226.6 million. Notably, Razorpay’s POS business experienced a substantial 60% growth in 2023, a momentum attributed to the acquisition of Ezetap in 2022.

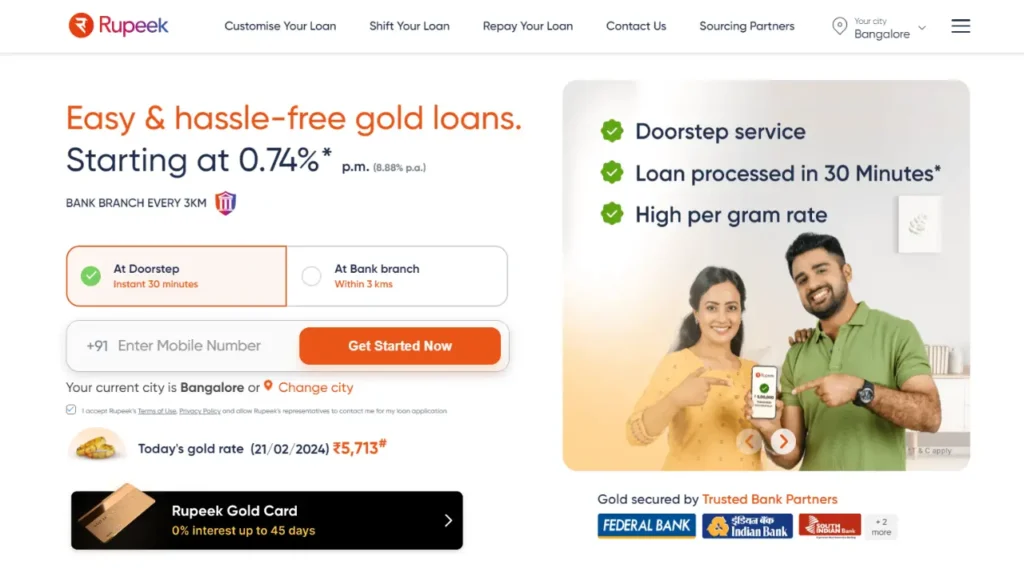

#6 Rupeek

Founded in 2015, Rupeek is a Bangalore-based B2C startup. The company, established by IIT Alumnus Sumit Maniyar. But what sets this startup apart from other Fintech Startups in Bangalore? Rupeek specializes in offering low-interest online gold loans, with a unique process that allows customers to avail themselves of loans from the comfort of their homes.

The company’s 4-step gold loan process emphasizes safety, personalization, and a stress-free experience. Currently serving over 5 lakh customers in 60+ cities, Rupeek’s focus is on making gold-backed loans an easily accessible financial solution for its customers.

Rupeek is approaching profitability, with an expected shift to EBITDA neutrality by August 2023, as reported by Mint. Despite a 27.6% revenue decrease from Rs 122.93 crore in 2022 to Rs 88.92 crore in 2023, Rupeek’s losses have also seen a significant reduction, decreasing from Rs 364.37 crore in 2022 to Rs 281.57 crore in 2023, as indicated by startupstorymedia.

#7 Navi

Another contender in the list of top Fintech Startups in Bangalore 2024 is Navi. Founded in December 2018 by Sachin Bansal and Ankit Agarwal, Navi aims to simplify financial services, making them transparent and accessible to all. Both co-founders bring diverse backgrounds, with Sachin being a former co-founder of Flipkart, India’s largest e-commerce player, and Ankit having a banking background with Deutsche Bank and Bank of America.

Navi adopts a technology-driven and customer-centric approach to offer a range of financial products. Navi has already served over 1.5 lac customers, becoming one of the country’s largest lending apps within just three months of its launch.

Navi’s operating revenue witnessed a remarkable 2.8X surge, reaching INR 1,283 Cr in the reported period 2023, compared to INR 457.1 Cr in FY22. In the quarter ended June 2023, its net profit rose to INR 26.2 Cr, a significant increase from INR 22.9 Cr in the corresponding period of the previous year. These figures demonstrate the company’s sustained profitability and financial health.

#8 Leap Finance

Leap Finance is among the emerging Fintech Startups in Bangalore, stands out as a financial services provider specializing in catering to the educational needs of Indian students pursuing international studies. Since its inception in 2019 by IIT Kharagpur graduates Arnav Kumar and Vaibhav Singh, the company has carved its niche in the market.

The primary focus of Leap Finance revolves around providing instant student loans to young Indians venturing abroad for education, particularly in the United States and Canada. What sets Leap Finance apart is its approach to defining the repayment period.

Despite its commendable services, Leap Finance faced a substantial widening of its net loss in the financial year 2021-22. The net loss escalated by 18.2 times, reaching INR 69.1 Cr, primarily attributed to a significant surge in expenses. However, on the revenue front, the company exhibited notable growth, with operating revenue soaring 3.7 times from INR 6.4 Cr in FY21 to INR 23.5 Cr in FY22.

#9 Cred

Another popular among the Fintech Startups in Bangalore is Cred, known for providing a range of financial services to its members. The company was founded in April 2018 by Kunal Shah. Cred focuses on credit card payments, allowing users to make payments through their members-only app. The platform encourages timely payments by rewarding members and offers exclusive experiences and rewards from premium brands.

Apart from credit card payments, Cred facilitates house rent payments and provides short-term credit lines to its users. Cred’s approach is user-centric, Members are rewarded for their financial prudence, creating an incentive for responsible financial behavior. This aligns with the company’s mission to encourage sound financial habits among its users.

In terms of revenue, Cred has shown remarkable growth. For the fiscal year 2023, ending March 31, the company’s total income skyrocketed to Rs 1,484 crore, marking a significant increase from Rs 422 crore in the previous year (FY2022). Notably, in FY2021, Cred had posted a total income of Rs 95 crore. This exponential growth in revenue underscores the company’s success and increasing user engagement within the fintech sector.

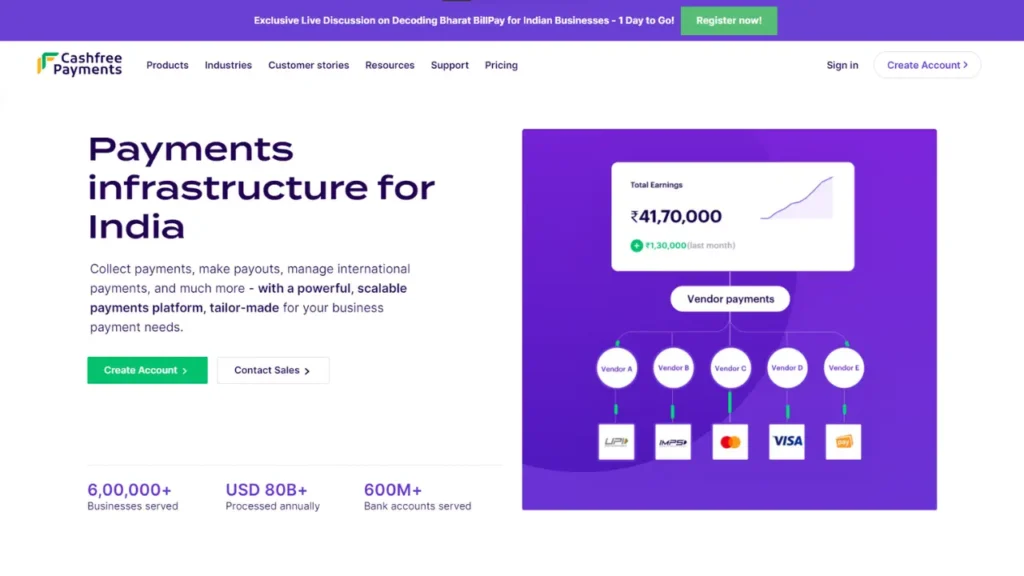

#10 CashFree Payments

CashFree Payments, popular name among the best Fintech Startups in Bangalore, offering a range of solutions for businesses. They specialize in facilitating money collection and transfers, managing international payments, and more. The company’s key offerings include API banking platform for disbursals, and a split payment solution tailored for marketplaces. Additionally, they provide a Bank Account Verification API and a dedicated UPI service.

Founded in 2015 by Akash Sinha and Reeju Datta, with a customer base exceeding 6,00,000 businesses, Cashfree Payments has gained trust in various financial operations such as payment collections, vendor payouts, salary disbursements, bulk refunds, and loyalty and rewards programs.

The company has achieved consistent profitability over the years. In the financial year 2021, Cashfree Payments reported a noteworthy 48% increase in net profit, amounting to Rs 25.22 crore. However, in the subsequent financial year of 2023, the company experienced a substantial 75% growth in revenue. Despite this, Cashfree Payments faced a reported loss of Rs 133 crore, attributed to significant expenses and investments made during that period.

The compilation of the top 10 Fintech Startups in Bangalore concludes here. However, with the escalating demand for online financial activities, a wave of emerging startups is poised to join the ranks of the fintech elite.